Benefits to Middle Class Tax Payers in the Budget 2015-16

No Change In Rate Of Personal Income Tax

Rationalization And Removal Of Various Tax Exemption

Exemption To Individual Tax Payers To Continue To Facilitate Savings

Atal Pension Yojana For Defined Pension, Government To Contribute 50% Of The Premium

Benefits to Middle Class Tax Payers in the Budget 2015-16

Payments to the Beneficiaries Including Interest Payment on Deposit in Sukanya Samriddhi Scheme to be Fully Exempt

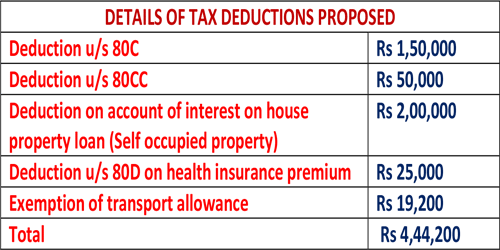

The Union Minister of Finance Shri Arun Jaitley in his Budget Speech in Lok Sabha today proposed rationalization of various tax exemptions and incentives to reduce tax disputes and improve tax administration. He said, with a view to encourage savings and to promote health care among individual tax payers, it is proposed to increase the limit of reduction of health insurance premium from Rs 15,000 to Rs 25,000 and for senior citizen this limit is increase from Rs 20,000 to Rs 30,000.

For senior citizen above the age of 80 years, not eligible to take health insurance, deduction is allowed for Rs 30,000 toward medical expenditure. Deduction limit of Rs 60,000 on expenditure on account of specified diseases is enhanced to Rs 80,000 in the case of senior citizens.

Additional deduction of Rs 25,000 is allowed for differently-abled persons, increasing the limit from Rs 50,000 to Rs 75,000. It is also proposed to increase the limit of deduction from Rs 1 lakh to Rs 1.25 lakh in case of severe disability.

The Finance Minister Shri Jaitley also proposed to provide that investment in Sukanya Samriddhi Scheme will be eligible for deduction under section 80C of the income-tax and any payment from the scheme shall not be liable to tax.

Limit on deduction on account of contribution to a pension fund and the new pension scheme is proposed to be increased from Rs 1 lakh to Rs 1.5 lakh.

Additional deduction of Rs 50,000 will be allowed for contribution to the new pension scheme u/s 80 CCD increasing from Rs 1 lakh to Rs 1.5 lakh.

Source:PIB

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates

I think it is not too late if Finance Minister raises limit from 2.5 lac to 3 lac of tax free income. This will pacify middle class and not hurt much to revenue of government also. Most popular PM shri Modiji should take stand on this as early as possible.